How can we help you?

You can find our services, products, publications and more.

The OBizz application has been developed to meet the demand for a quicker, more secure, and user-friendly loan application process at ING. As the necessity for documentation and ensuing approvals became onerous, the rate of loan utilisation declined, particularly during the pandemic.

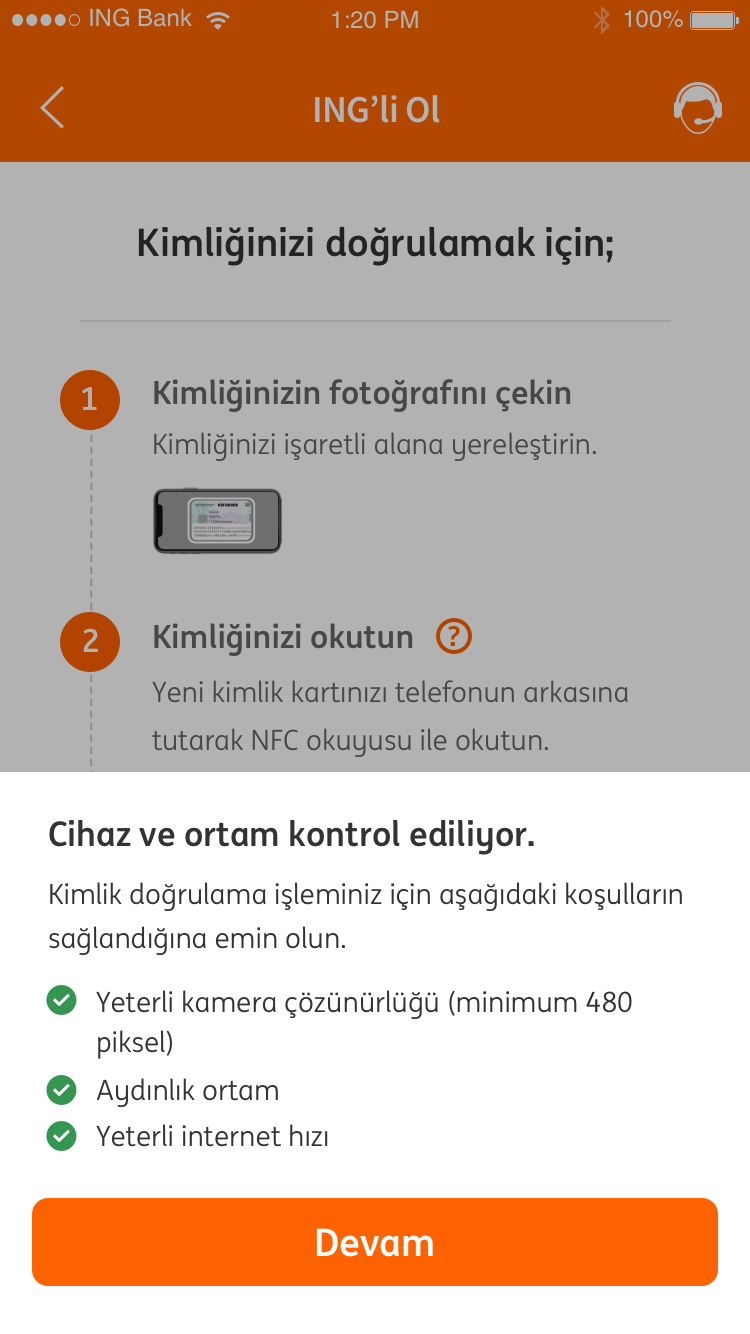

To lessen the gap between application and approval, we have created OBizz, an effective and straightforward mobile application that more efficiently matches loans to business customers.

Owing to the pandemic, the transfer of essential documents for record-keeping or signatures was frequently delayed, especially for new customers. These delays consequently led prospective clients to look for alternative methods to obtain loans more rapidly, thereby reducing ING’s financial throughput.

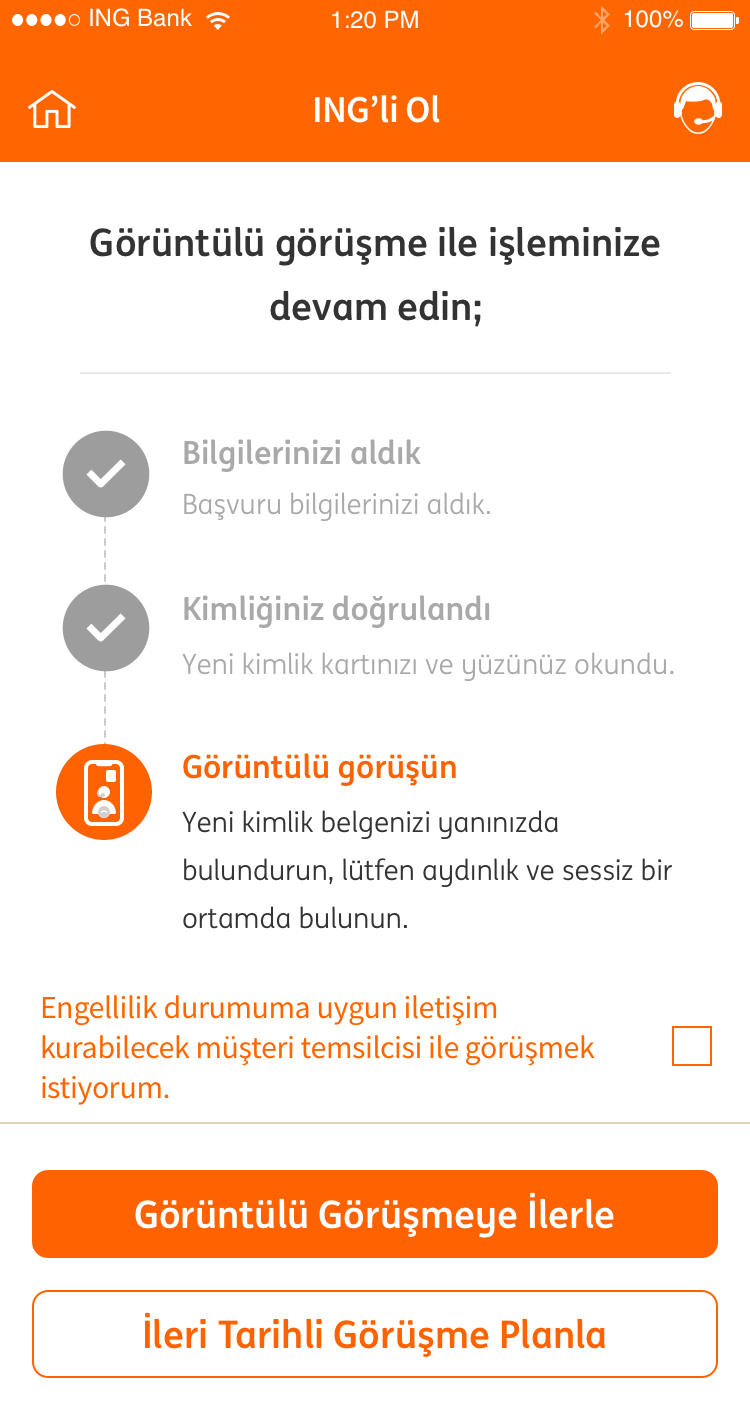

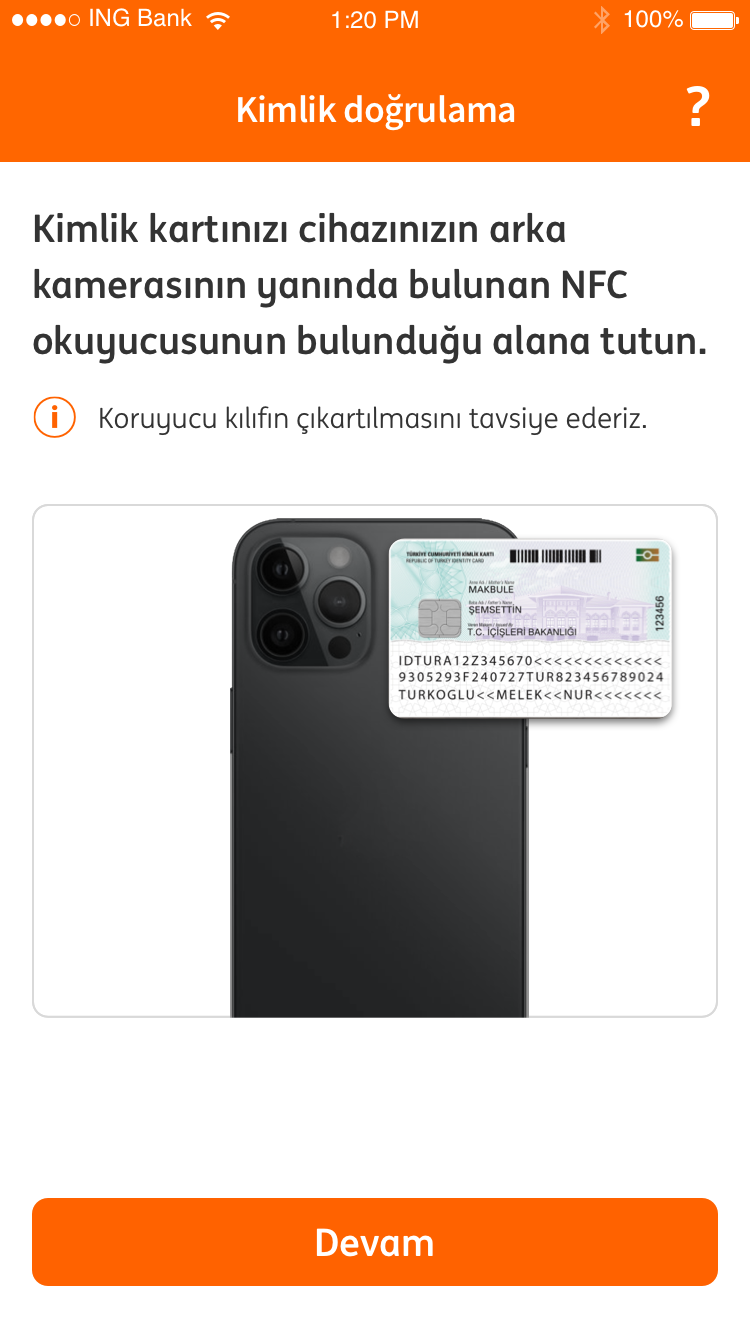

ING has thoroughly overhauled the infrastructure for assessing private companies and enhanced the range of loan options available to customers. Additionally, in partnership with OBSS, ING has decreased and optimised the response time to customers by completely rewriting the credit evaluation processes in line with micro-service architectural infrastructure. This has led to an increase in previously lower loan approval and utilisation rates. ING has focused on user experience, advocating for the introduction of user-friendly applications.

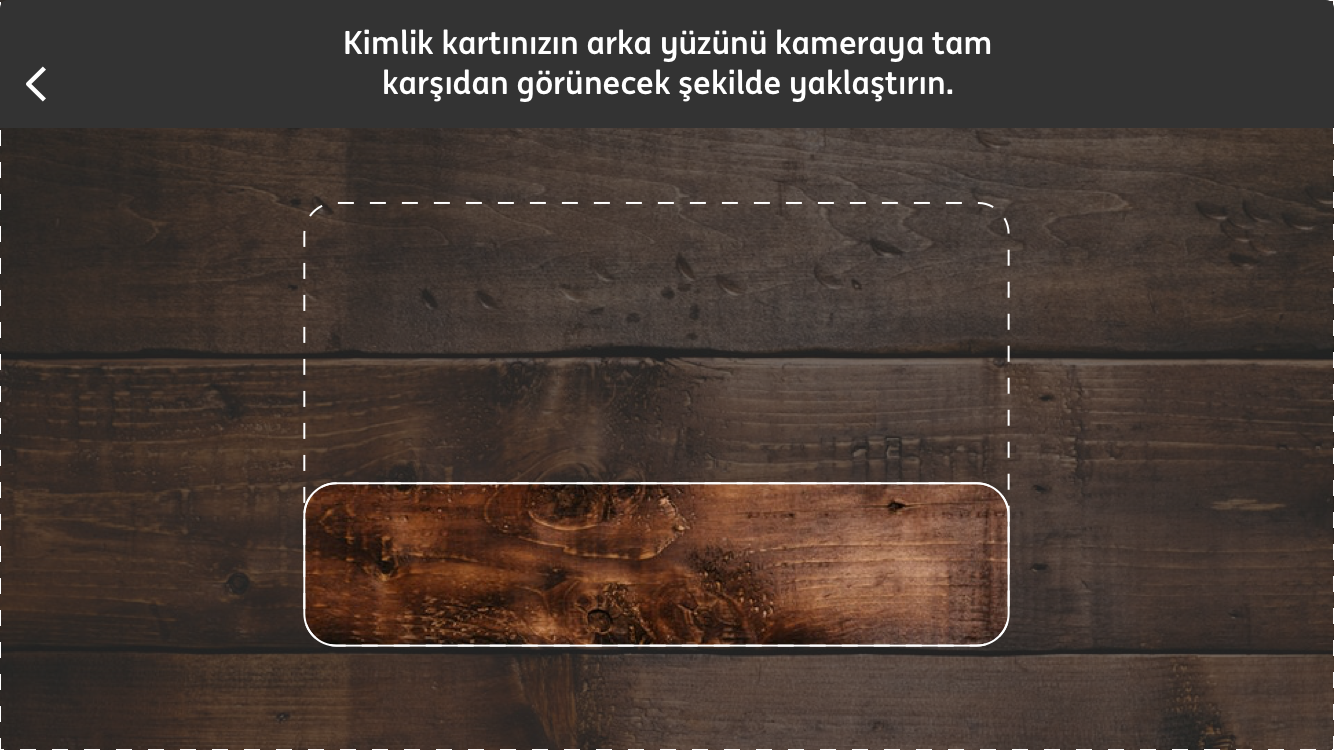

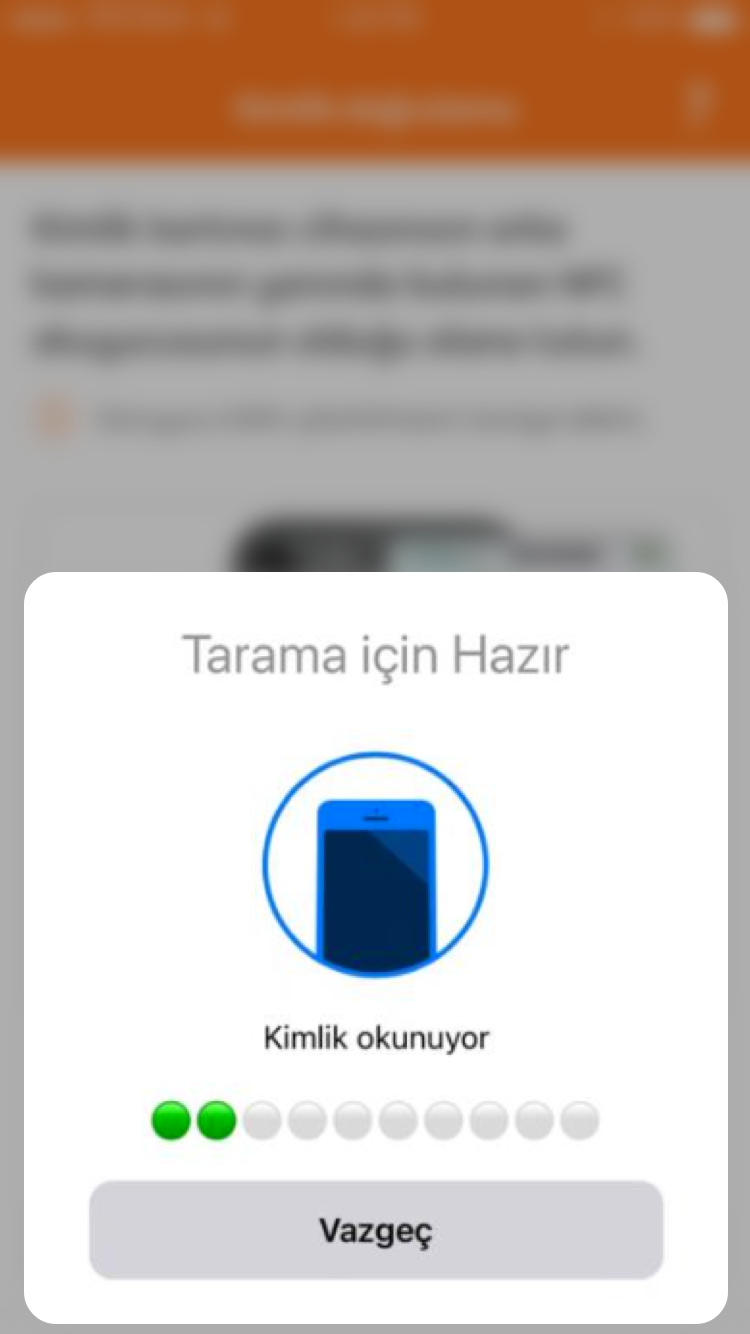

The process for becoming a customer at ING has been expedited by introducing a digital document approval option, replacing the previous courier booking step in the application process. This change has enabled private companies to become ING customers by submitting an online application in a very short period, akin to ING’s retail customers. Furthermore, ING has provided customers with options for credit cards and overdraft accounts alongside loans, increasing the available choices for customers needing urgent cash for trading during the pandemic.

Web site

iOS app

Android app

Thanks to these enhancements, with invaluable contributions from OBSS, ING effectively raised customer application approval rates to the targeted levels. The most recent reports indicate that 1 out of every 2 customers granted approval has successfully completed the refined loan application process. OBSS played a pivotal role in this achievement by closely collaborating with ING to implement these enhancements.

ING is a pioneer in digital banking and on the forefront being one of the most innovative banks in the world. As ING we have a clear purpose that represents our conviction of people’s potential. We don’t judge, coach, or tell people how to live their lives. However big or small, modest or grand, we empower people and businesses to realize their vision for a better future. We made the promise to make banking frictionless, remove barriers to progress, and make people confident in their financial decisions. As a global bank we have a huge opportunity – and responsibility – to make an impact for the better. We can play a role by financing change, sharing knowledge, and innovating. Being sustainable is in all the choices we make—as a lender, as a partner, and through the services we offer our customers.

Welcome To OBSS. I'm Hale.

We're a team of over 850 senior developers, 30 software architects and project managers.

We open opportunities for growth and productivity with software.

Get in touch ⬇️